Necessary Steps to Get and Make Use Of Bid Bonds Properly

Navigating the complexities of bid bonds can substantially influence your success in securing contracts. To approach this successfully, it's critical to recognize the essential steps involved, from gathering required paperwork to selecting the right surety company. The journey begins with organizing your economic declarations and a comprehensive portfolio of previous tasks, which can demonstrate your reliability to potential sureties. However, the actual difficulty lies in the precise selection of a credible copyright and the tactical usage of the bid bond to enhance your one-upmanship. What complies with is a better look at these critical stages.

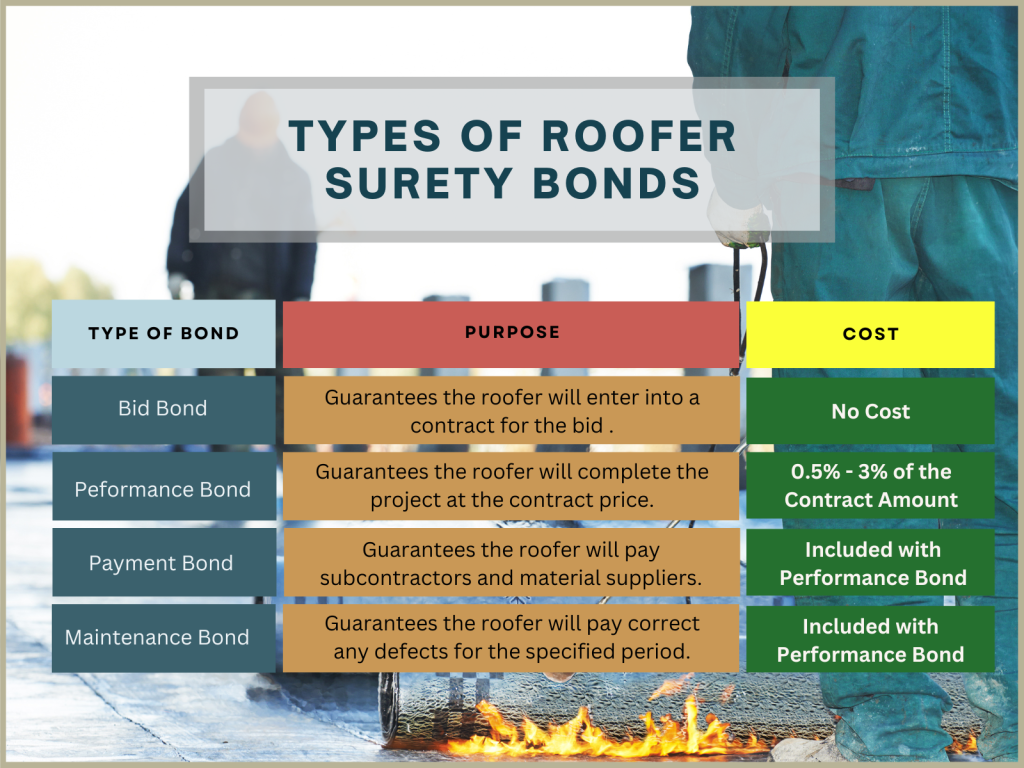

Understanding Bid Bonds

Bid bonds are a vital element in the construction and having industry, functioning as an economic guarantee that a bidder means to participate in the contract at the proposal cost if awarded. Bid Bonds. These bonds alleviate the danger for project owners, ensuring that the chosen specialist will not only recognize the bid yet additionally protected efficiency and payment bonds as needed

Essentially, a quote bond works as a protect, securing the task owner against the monetary effects of a professional taking out a bid or falling short to start the task after selection. Typically provided by a guaranty firm, the bond guarantees compensation to the proprietor, frequently 5-20% of the quote quantity, need to the contractor default.

In this context, bid bonds foster an extra affordable and trustworthy bidding process atmosphere. Bid bonds play a crucial function in keeping the honesty and smooth operation of the construction bidding procedure.

Preparing for the Application

When planning for the application of a proposal bond, precise company and extensive documentation are extremely important. An extensive evaluation of the task specifications and quote needs is vital to ensure conformity with all specifications. Start by setting up all required economic statements, including equilibrium sheets, revenue statements, and cash money flow statements, to show your firm's monetary health and wellness. These documents ought to be existing and prepared by a licensed accounting professional to improve integrity.

Next, assemble a listing of previous jobs, specifically those comparable in scope and dimension, highlighting successful conclusions and any kind of qualifications or honors obtained. This profile functions as proof of your firm's capability and reliability. Additionally, prepare a comprehensive company strategy that outlines your functional approach, threat monitoring methods, and any kind of backup prepares in position. This plan provides a holistic view of your company's approach to task execution.

Ensure that your company licenses and registrations are current and easily available. Having these documents arranged not just accelerates the application procedure however also forecasts a professional photo, instilling confidence in possible surety service providers and task owners - Bid Bonds. By systematically preparing these elements, you place your company favorably for effective bid bond applications

Finding a Surety Service Provider

Additionally, consider the copyright's experience in your certain sector. A surety firm knowledgeable about your field will certainly much better comprehend the one-of-a-kind threats and demands linked with your projects. Demand references and inspect their history of claims and client contentment. It is also a good idea to review their monetary ratings from companies like A.M. Finest or Criterion & Poor's, ensuring they have the financial stamina to back their bonds.

Engage with several providers to contrast solutions, rates, and terms. A competitive assessment will certainly aid you safeguard the most effective terms for your bid bond. Eventually, a comprehensive vetting process will ensure a reliable partnership, cultivating self-confidence in your proposals and future jobs.

Submitting the Application

Submitting the application for a quote bond is a crucial action that calls for careful interest to information. This process starts by collecting all appropriate documentation, including economic declarations, project specifications, and a comprehensive organization background. Making certain my response the accuracy and efficiency of these papers is vital, as any inconsistencies can cause delays or rejections.

When filling out the application, it is recommended to confirm all entrances for precision. This includes validating numbers, making certain correct trademarks, and confirming that all required attachments are included. Any mistakes or noninclusions can weaken your application, creating unnecessary my latest blog post problems.

Leveraging Your Bid Bond

Leveraging your proposal bond successfully can significantly improve your affordable side in securing agreements. A proposal bond not only demonstrates your economic stability but likewise reassures the job proprietor of your commitment to satisfying the agreement terms. By showcasing your proposal bond, you can underline your company's dependability and reputation, making your quote stick out amongst numerous competitors.

To leverage your bid bond to its fullest potential, ensure it exists as component of an extensive quote plan. Highlight the stamina of your guaranty go right here provider, as this shows your firm's monetary health and wellness and functional capacity. In addition, stressing your record of successfully finished tasks can further instill confidence in the project proprietor.

Additionally, preserving close interaction with your surety supplier can promote far better conditions in future bonds, hence reinforcing your affordable placing. An aggressive strategy to handling and restoring your bid bonds can also prevent gaps and make certain continual insurance coverage, which is important for ongoing task procurement initiatives.

Verdict

Efficiently making use of and acquiring bid bonds necessitates detailed prep work and critical execution. By comprehensively organizing key paperwork, choosing a respectable surety provider, and sending a total application, firms can safeguard the essential proposal bonds to improve their competitiveness. Leveraging these bonds in propositions underscores the firm's dependability and the stamina of the surety, eventually enhancing the chance of protecting agreements. Constant communication with the surety provider makes sure future opportunities for effective job proposals.

Identifying a respectable guaranty supplier is a critical action in securing a bid bond. A quote bond not just shows your economic stability but additionally reassures the job owner of your dedication to meeting the agreement terms. Bid Bonds. By showcasing your bid bond, you can underscore your company's integrity and reliability, making your quote stand out among many rivals

To leverage your quote bond to its max capacity, ensure it is provided as part of an extensive bid plan. By adequately arranging vital documents, picking a credible guaranty supplier, and submitting a full application, companies can safeguard the needed proposal bonds to enhance their competition.